Apple Share Price Hits $600, Just One Month After Hitting $500

Apple's share price touched the $600 mark as trading opened this morning, just a month after reaching $500/share for the first time. The stock has, however, pulled back slightly since the open and now sits at $594.

The stock price has been on a tear ever since Apple reported blowout earnings for the first fiscal quarter of 2012, rising nearly $180/share, or close to 40%, in under two months.

At the end of February, Apple broke through the important psychological barrier of $500 billion in market capitalization. Apple is the most valuable publicly traded company in the world, worth nearly $560 billion, more than $150 billion higher than second-place ExxonMobil.

Apple is now within $50 billion of claiming the "most valuable publicly traded company ever" title. According to the S&P, Microsoft had a peak market cap of $604 billion during the dot-com boom in December 1999. Adjusted for inflation, Microsoft was worth $813.42 billion in January 2012 dollars at its peak, and Apple would have to reach $873/share to surpass that total.

Popular Stories

Apple is planning to launch new MacBook Pro models as soon as early March, but if you can, this is one generation you should skip because there's something much better in the works.

We're waiting on 14-inch and 16-inch MacBook Pro models with M5 Pro and M5 Max chips, with few changes other than the processor upgrade. There won't be any tweaks to the design or the display, but later this...

Wednesday February 11, 2026 10:07 am PST by

Juli CloverApple today released iOS 26.3 and iPadOS 26.3, the latest updates to the iOS 26 and iPadOS 26 operating systems that came out in September. The new software comes almost two months after Apple released iOS 26.2 and iPadOS 26.2.

The new software can be downloaded on eligible iPhones and iPads over-the-air by going to Settings > General > Software Update.

According to Apple's release notes, ...

It has been a slow start to 2026 for Apple product launches, with only a new AirTag and a special Apple Watch band released so far. We are still waiting for MacBook Pro models with M5 Pro and M5 Max chips, the iPhone 17e, a lower-cost MacBook with an iPhone chip, long-rumored updates to the Apple TV and HomePod mini, and much more.

Apple is expected to release/update the following products...

Apple plans to announce the iPhone 17e on Thursday, February 19, according to Macwelt, the German equivalent of Macworld.

The report said the iPhone 17e will be announced in a press release on the Apple Newsroom website, so do not expect an event for this device specifically.

The iPhone 17e will be a spec-bumped successor to the iPhone 16e. Rumors claim the device will have four key...

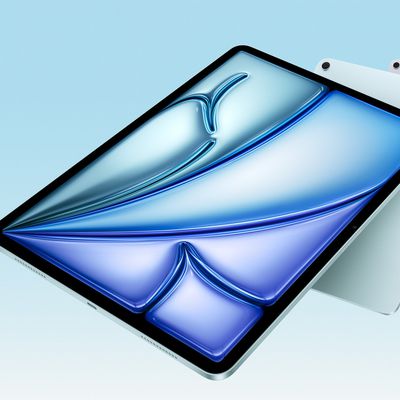

Apple plans to release an iPhone 17e and an iPad Air with an M4 chip "in the coming weeks," according to the latest word from Bloomberg's Mark Gurman.

"Apple retail employees say that inventory of the iPhone 16e has basically dried out and the iPad Air is seeing shortages as well," said Gurman. "I've been expecting new versions of both (iPhone 17e and M4 iPad Air) in the coming weeks."...