Analyst Predicts Next-Generation iPhone Will Offer Lower Total Cost of Ownership

Fortune reports on a new research note from prominent Morgan Stanley analyst Katy Huberty citing strong sales of Apple's iPad and the potential for increased growth in the iPhone segment from new models she predicts will carry lower total cost of ownership as drivers for Apple's stock price over the next several years.

In a report to clients issued Friday, Morgan Stanley's Katy Huberty offered one of her patented risk-reward snapshots of Apple (AAPL), this one even more optimistic than the last, thanks to what she sees as two new catalysts:

- The iPad launch in March. Huberty is anticipating unit sales of 6 million in calendar 2010, considerably higher than the Street's consensus of 3-4 million

- New iPhones in June. She's expecting new models that offer "both a lower total cost of ownership and new functionality, potentially including gesture-based technology"

Huberty doesn't appear to have elaborated on the basis for her iPhone prediction or exactly what she means by "gesture-based technology", and it is unclear whether such cost of ownership savings would primarily come from the cost of the device itself or the much more significant monthly subscription pricing offered through Apple's partner carriers, as both have been cited as significant barriers to entry for customers.

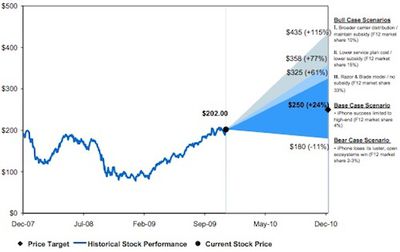

As part of her analysis, Huberty offers three "bull scenarios" that see Apple's stock pricing surging to between $325 and $435 by fiscal year 2012 depending on the balance between subsidies paid to Apple by carriers and global market share. Huberty also offers tamer scenarios in which Apple's iPhone proves to show slower growth, and projecting stock prices in the $180-$250 range.

Popular Stories

Apple's next-generation iPhone 17 Pro and iPhone 17 Pro Max are less than three months away, and there are plenty of rumors about the devices.

Apple is expected to launch the iPhone 17, iPhone 17 Air, iPhone 17 Pro, and iPhone 17 Pro Max in September this year.

Below, we recap key changes rumored for the iPhone 17 Pro models:Aluminum frame: iPhone 17 Pro models are rumored to have an...

The long wait for an Apple Watch Ultra 3 appears to be nearly over, and it is rumored to feature both satellite connectivity and 5G support.

Apple Watch Ultra's existing Night Mode

In his latest Power On newsletter, Bloomberg's Mark Gurman said that the Apple Watch Ultra 3 is on track to launch this year with "significant" new features, including satellite connectivity, which would let you...

The upcoming iPhone 17 Pro and iPhone 17 Pro Max are rumored to have a slightly different MagSafe magnet layout compared to existing iPhone models, and a leaked photo has offered a closer look at the supposed new design.

The leaker Majin Bu today shared a photo of alleged MagSafe magnet arrays for third-party iPhone 17 Pro cases. On existing iPhone models with MagSafe, the magnets form a...

Apple is developing a MacBook with the A18 Pro chip, according to findings in backend code uncovered by MacRumors.

Earlier today, Apple analyst Ming-Chi Kuo reported that Apple is planning to launch a low-cost MacBook powered by an iPhone chip. The machine is expected to feature a 13-inch display, the A18 Pro chip, and color options that include silver, blue, pink, and yellow.

MacRumors...

Apple is planning to launch a low-cost MacBook powered by an iPhone chip, according to Apple analyst Ming-Chi Kuo.

In an article published on X, Kuo explained that the device will feature a 13-inch display and the A18 Pro chip, making it the first Mac powered by an iPhone chip. The A18 Pro chip debuted in the iPhone 16 Pro last year. To date, all Apple silicon Macs have contained M-series...

iOS 26 and iPadOS 26 add a smaller yet useful Wi-Fi feature to iPhones and iPads.

As spotted by Creative Strategies analyst Max Weinbach, sign-in details for captive Wi-Fi networks are now synced across iPhones and iPads running iOS 26 and iPadOS 26. For example, while Weinbach was staying at a Hilton hotel, his iPhone prompted him to fill in Wi-Fi details from his iPad that was already...

Apple today seeded the second betas of upcoming iOS 18.6 and iPadOS 18.6 updates to public beta testers, with the betas coming just a day after Apple provided the betas to developers. Apple has also released a second beta of macOS Sequoia 15.6.

Testers who have signed up for beta updates through Apple's beta site can download iOS 18.6 and iPadOS 18.6 from the Settings app on a compatible...

Apple hasn't updated the AirPods Pro since 2022, and the earbuds are due for a refresh. We're counting on a new model this year, and we've seen several hints of new AirPods tucked away in Apple's code. Rumors suggest that Apple has some exciting new features planned that will make it worthwhile to upgrade to the latest model.

Subscribe to the MacRumors YouTube channel for more videos.

Heal...

As part of its 10-year celebrations of Apple Music, Apple today released an all-new personalized playlist that collates your entire listening history.

The playlist, called "Replay All Time," expands on Apple Music's existing Replay features. Previously, users could only see their top songs for each individual calendar year that they've been subscribed to Apple Music, but now, Replay All...