Earlier this year, we offered a preview of "iBank Access", an iPad version of IGG Software's personal finance software. With Intuit's Quicken for Mac having fallen out of favor after being remade with drastically simpler functionality that many users have found insufficient for their needs, iBank for Mac has become a popular option for those looking to keep track of their finances.

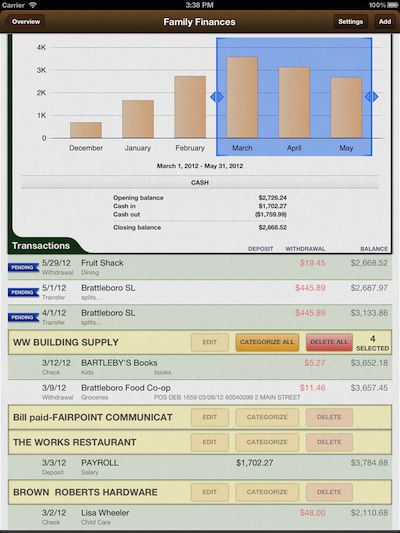

Beyond iBank for Mac, IGG Software has offered a companion iPhone app for some time, but the move to the iPad opens up a number of different possibilities for the app on iOS. As work on iBank Access continued, IGG realized that the app was indeed a nearly full-fledged version of iBank, and so the app was rebranded as iBank for iPad. Launching in the App Store today for $14.99, iBank for iPad offers a number of features for tracking expenditures, budgeting, managing investments, and more.

As we mentioned in our preview earlier this year, IGG is also rolling out a new subscription service known as Direct Access that provides for automatic updating of financial transactions in the background from thousands of financial institutions. iBank for iPad comes with a free 30-day trial of Direct Access that can be continued via In App Purchase for $4.99 per month or $39.99 per year. Alternatively, users can sync with the desktop version of iBank via Wi-Fi or WebDAV server free of charge.

Along with the release of iBank for iPad, IGG is discounting the Mac version of iBank by $10 through July 8, pricing the software at $49.99 through both the Mac App Store and IGG's web store.

Top Rated Comments

We simply don't do paid posts. We'll occasionally promote a software bundle where we earn a referral cut of the proceeds, but we clearly disclose that in those articles and we post them because we think people will be interested in them, not because we can make money off of them.

Occasionally we will use referral links for products through Amazon or Adobe, and links to apps through our AppShopper site generate revenue through the iTunes affiliate program. But the income from these avenues has no influence on our editorial decisions.

I posted about iBank because it's a popular option for Mac users looking for personal finance solutions. People have been asking for an iPad app for quite some time, and this appears to be quite full-featured.

Some may feel the price is too high, and that's fine...buy it or don't buy it. I will say that Direct Access isn't designed to be a money-maker for IGG...it's delivered through a third-party service that IGG has to pay for, and that cost gets passed along to the user since IGG isn't a charity.

In general, I agree. But many people prefer not to have their full financial information being used to develop a profile. Others worry that Mint will begin selling the actual information to advertisers and other parties. That seems unlikely, especially without users having a means to opt out, but it is a concern for a significant number of people.

Your choice how the software gets paid for...your pocketbook with iBank or your personal financial information with Mint.

I want to chime in here to clear up some ambiguity, but not without mentioning my institutional bias: I work for IGG.

iBank for iPad isn't a free app for a few reasons, but if the comparison is with Mint, we believe iBank offers a more robust feature set, including a more advanced interface, better investment tracking, superior budgeting, and a full set of capabilities for managing transactions (to split, reconcile, categorize, schedule, etc.) - among other tools. If those things are worth paying for, we hope people will be interested in the product.

As noted elsewhere in this thread, we don't sell customer info or account data, or market anything to users. So while the point of charging for automated downloads is to provide a valuable, convenient service, it also means we to get to run a business without selling out our users. Note that there is no requirement to subscribe to Direct Access at all; you can manually enter data into the app, and users of our desktop version of iBank can simply sync their account data to the iPad version.

There are lots of "free" services that people use daily, including Google, Facebook and Mint. But as someone said to me recently, if you don't pay for the product... you ARE the product. That's just a different business model, and one we consciously aimed to avoid.

mint.com is free