Amit Daryanani

By MacRumors Staff

Amit Daryanani Articles

This Year's iPhone X and iPhone X Plus Could Start at $899 and $999 Respectively Says RBC Analyst

Apple's second-generation iPhone X and so-called iPhone X Plus could be priced from $899 and $999 respectively in the United States, according to RBC Capital Markets analyst Amit Daryanani.

iPhone X and iPhone X Plus dummy models via Ben Geskin

Daryanani said the current iPhone X has experienced "limited success" at $999 and up, leading him to believe that lowering the base price by $100...

Read Full Article 172 comments

Over Half of Prospective iPhone X Buyers Surveyed Plan to Choose 256GB Storage

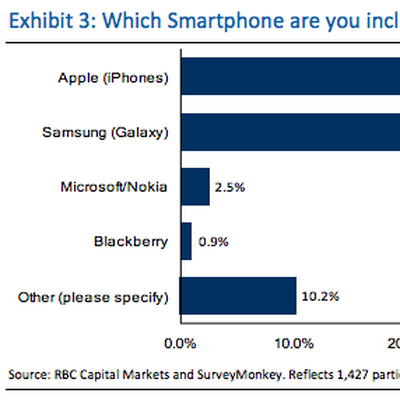

iPhone X with 256GB storage is the most popular device among prospective smartphone buyers, according to a survey conducted by RBC Capital Markets.

Of the 832 individuals surveyed, 28 percent said they plan to purchase iPhone X as their next smartphone. An additional 20 percent of respondents said they intend to buy iPhone 8 Plus, while 17 percent will go for iPhone 8.

The remaining 35...

Bullish Analyst Says Apple Has Potential to Become Trillion Dollar Company Within 18 Months

Apple has the potential to become a trillion dollar company by 2019, according to RBC Capital Markets analyst Amit Daryanani.

In a research note on Monday, Daryanani said Apple could reach or exceed a trillion dollar market cap within the next 12 to 18 months.

An excerpt from Daryanani's research note, edited slightly for clarity:In aggregate, we see a scenario where in the 2019 fiscal...

RBC Raises Price Target on Apple Shortly After Dreaming About Benefits of a Merger With Disney

RBC Capital Markets raised its AAPL price target to $157 today, up from $155, as it believes iPhone sales were stable to modestly better than expected in Apple's second quarter, which ended on March 31.

The investment bank's lead Apple analyst Amit Daryanani said the company's iPhone mix continues to remain positive, with "more" Plus-sized models sold in the quarter than it previously...

iPhone 6 Interest Remains Strong as Consumers Look to Larger Displays

Demand for the next generation iPhone remains strong in the months before its expected fall debut, claims a report from RBC Capital Markets analysts. According to a 4,000 person survey conducted by RBC, half of consumers who plan to upgrade their phone in the next three months intend to buy an iPhone and a quarter of those would be willing to pay $100 more for their iPhone to have a 5.5-inch...

Apple's Lower-Cost iPhone to Lack Retina Display?

RBC Capital Markets analyst Amit Daryanani has released a new research report today citing supply chain checks as the basis for predicting a June or July launch for both the iPhone 5S and a lower-cost iPhone, in line with other recent reports. Daryanani says, however, that the lower-cost iPhone appears set to omit a Retina display.Our supply-chain checks indicate that AAPL is working to launch...