Apple Card has a new Monthly Installments financing option that allows customers to purchase an iPhone with the Apple Card and pay for it over two years with no interest or fees in the United States.

Apple has shared a new support document explaining how the monthly installment plan works, which we've detailed below.

When using Monthly Installments, the cost of your new iPhone is divided into 24, interest-free monthly installments. Each installment is included in your Apple Card minimum payment and is due every month for 24 months. Monthly Installments are billed to your Apple Card statement on the last day of the month.

You can use Apple Card Monthly Installments to buy more than one iPhone. The number of iPhones you can buy is only limited by your available credit.

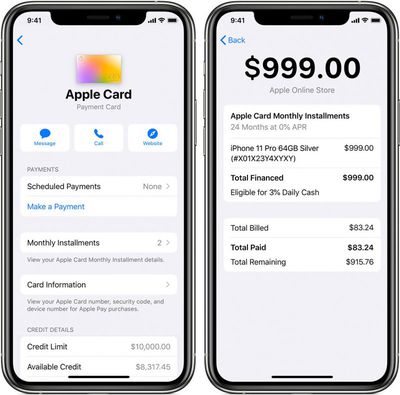

For each iPhone purchased with the Apple Card, you will receive 3% Daily Cash. If the iPhone is purchased between December 10 and December 31, it is eligible for a doubled 6% Daily Cash as part of a holiday promotion.

AppleCare+ can be bundled with the iPhone as part of the monthly installments.

How to View and Pay Apple Card Monthly Installments

Paying for an Apple Card Monthly Installment is as simple as paying off your minimum payment or higher each month.

To see and manage your Apple Card Monthly Installments, update to iOS 13.2 or later. Then, open the Wallet app, tap on your Apple Card, tap the button with three-dots in the top-right corner, and tap Installments.

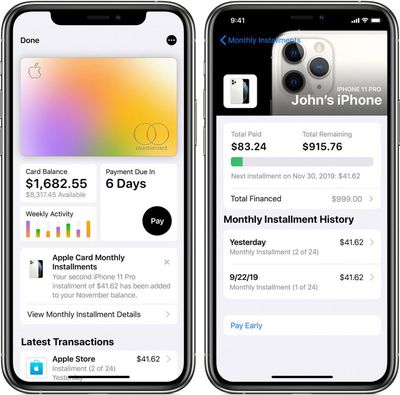

The installments screen shows the total amount paid off so far, the remaining balance, the due date and amount of your next monthly installment, and a history of your monthly payments. There is also a Pay Early option that can reduce the number of payments, but this requires paying off your entire Apple Card balance first.

If you tap Total Financed, you can review other details like a description of the iPhone you purchased and how much Daily Cash you received.

As a shortcut, when you purchase an iPhone with Apple Card Monthly Installments, you will receive a notification on the iPhone or iPad you use to manage your Apple Card that can be tapped to view installment details.

Apple Card Monthly Installments are available for purchases made at Apple Stores, Apple.com, and through the Apple Store app.

Apple already offered interest-free iPhone financing through its iPhone Upgrade Program, but the Apple Card plan has a few advantages, including cash back, managing payments in the Wallet app, and no late fees.