Barclays Finally Supports Apple Pay in United Kingdom

Barclays appears to have enabled much-anticipated support for Apple Pay in the United Kingdom during the early morning hours on Tuesday.

A growing number of Barclays customers on Twitter have been successfully able to add their debit or credit cards from the large British bank to Apple Pay since shortly after midnight local time.

Barclays was notably absent from the list of banks and participating issuers supporting Apple Pay when the mobile payments service first expanded to England, Scotland, Wales, and Northern Ireland in July 2015.

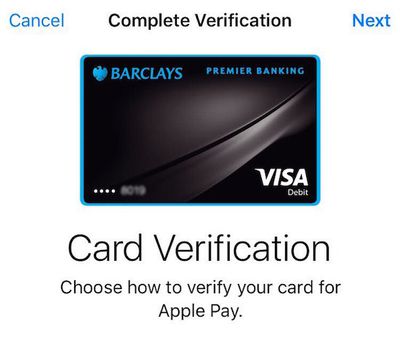

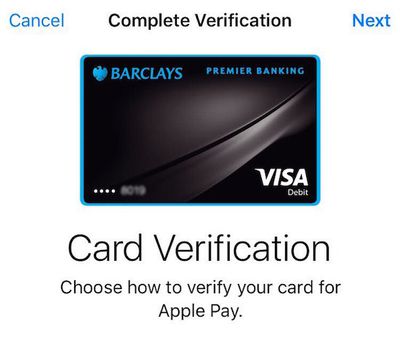

Barclays cardholders can set up Apple Pay through the Wallet app on iOS 8.1 or later. Bank-issued cards can be scanned or added manually by tapping the "Add Credit or Debit Card" option. Follow the on-screen verification steps.

Apple Pay is also supported at Bank of Scotland, First Direct, Halifax, HSBC, Lloyds Bank, M&S Bank, MBNA, Nationwide, NatWest, Royal Bank of Scotland, Santander, Tesco Bank, TSB, and Ulster Bank in the United Kingdom.

Popular Stories

Apple will launch its new iPhone 17 series in two months, and the iPhone 17 Pro models are expected to get a new design for the rear casing and the camera area. But more significant changes to the lineup are not expected until next year, when the iPhone 18 models arrive.

If you're thinking of trading in your iPhone for this year's latest, consider the following features rumored to be coming...

A new Apple TV is expected to be released later this year, and a handful of new features and changes have been rumored for the device.

Below, we recap what to expect from the next Apple TV, according to rumors.

Rumors

Faster Wi-Fi Support

The next Apple TV will be equipped with Apple's own combined Wi-Fi and Bluetooth chip, according to Bloomberg's Mark Gurman. He said the chip supports ...

Apple's next-generation iPhone 17 Pro and iPhone 17 Pro Max are only two months away, and there are plenty of rumors about the devices.

Below, we recap key changes rumored for the iPhone 17 Pro models.

Latest Rumors

These rumors surfaced in June and July:A redesigned Dynamic Island: It has been rumored that all iPhone 17 models will have a redesigned Dynamic Island interface — it might ...

Apple does not plan to refresh any Macs with updated M5 chips in 2025, according to Bloomberg's Mark Gurman. Updated MacBook Air and MacBook Pro models are now planned for the first half of 2026.

Gurman previously said that Apple would debut the M5 MacBook Pro models in late 2025, but his newest report suggests that Apple is "considering" pushing them back to 2026. Apple is now said to be...

iPhone 17 Pro and iPhone 17 Pro Max models with displays made by BOE will be sold exclusively in China, according to a new report.

Last week, it emerged that Chinese display manufacturer BOE was aggressively ramping up its OLED production capacity for future iPhone models as part of a plan to recapture a major role in Apple's supply chain.

Now, tech news aggregator Jukan Choi reports...

The long wait for an Apple Watch Ultra 3 is nearly over, and a handful of new features and changes have been rumored for the device.

Below, we recap what to expect from the Apple Watch Ultra 3:Satellite connectivity for sending and receiving text messages when Wi-Fi and cellular coverage is unavailable

5G support, up from LTE on the Apple Watch Ultra 2

Likely a wide-angle OLED display that ...

In select U.S. states, residents can add their driver's license or state ID to the Wallet app on the iPhone and Apple Watch, providing a convenient and contactless way to display proof of identity or age at select airports and businesses, and in select apps.

Unfortunately, this feature continues to roll out very slowly since it was announced in 2021, with only nine U.S. states, Puerto Rico,...

The iPhone 17 and iPhone 17 Air will be available in a total of nine color options, according to new information coming out of Asia.

The iPhone 17 Air's expected color options.

According to the leaker going by the account name "yeux1122" on the Korean blog Naver, accessory manufacturers are now producing camera protector rings for the iPhone 17 and iPhone 17 Air in colors to match their...