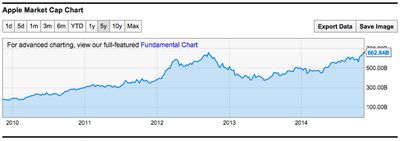

Apple's Market Capitalization Sets First New Record High in Two Years at Over $660 Billion

Apple's market capitalization reached a record high today, breaking the $660 billion mark to sit in the range of $662-664 billion for much of the day's trading so far. The new high breaks a previous closing record of $658.15 billion set on September 19, 2012 and intraday high of nearly $661 billion reached two days later. Market capitalization measures the market value of a business and is calculated by multiplying the stock price by the number of available shares.

Apple comfortably leads all U.S. companies in market capitalization, with its closest competitors being Microsoft and Exxon, which have market capitalizations of just over $400 billion each. Fourth-place Google falls sits at roughly $370 billion.

While Apple's share price has been routinely setting new records since surpassing its previous September 2012 high in August, it has taken a bit longer for Apple to return to its record market capitalization levels as the company's expanded stock buyback program has reduced the number of outstanding shares.

Apple's stock has surged 17 percent in just the four weeks since Apple's October media event and subsequent earnings announcement where the company announced strong fiscal Q4 2014 earnings fueled by the iPhone 6, iPhone 6 Plus and record Mac sales. The company's share price is up approximately 50 percent over the past twelve months.

Apple last quarter reported $8.5 billion in profit on $42.1 billion in revenue with sales of 39 million iPhones, 12.31 iPads and 5.5 million Mac units. While Mac and iPhone revenue climbed, iPad sales slumped with quarterly revenue dropping 14 percent year over year and 10 percent from the previous quarter. iPad sales are expected to temporarily rebound in the upcoming quarter following the introduction of the new iPad Air 2, with holiday season discounts expected to propel sales of Apple hardware.

Popular Stories

The long wait for an Apple Watch Ultra 3 appears to be nearly over, and it is rumored to feature both satellite connectivity and 5G support.

Apple Watch Ultra's existing Night Mode

In his latest Power On newsletter, Bloomberg's Mark Gurman said that the Apple Watch Ultra 3 is on track to launch this year with "significant" new features, including satellite connectivity, which would let you...

The iPhone 17 Pro Max will feature the biggest ever battery in an iPhone, according to the Weibo leaker known as "Instant Digital."

In a new post, the leaker listed the battery capacities of the iPhone 11 Pro Max through to the iPhone 16 Pro Max, and added that the iPhone 17 Pro Max will feature a battery capacity of 5,000mAh:

iPhone 11 Pro Max: 3,969mAh

iPhone 12 Pro Max: 3,687mAh...

Apple's next-generation iPhone 17 Pro and iPhone 17 Pro Max are just over two months away, and there are plenty of rumors about the devices.

Below, we recap key changes rumored for the iPhone 17 Pro models.

Latest Rumors

These rumors surfaced in June and July:Apple logo repositioned: Apple's logo may have a lower position on the back of the iPhone 17 Pro models, compared to previous...

The upcoming iPhone 17 Pro and iPhone 17 Pro Max are rumored to have a slightly different MagSafe magnet layout compared to existing iPhone models, and a leaked photo has offered a closer look at the supposed new design.

The leaker Majin Bu today shared a photo of alleged MagSafe magnet arrays for third-party iPhone 17 Pro cases. On existing iPhone models with MagSafe, the magnets form a...

Apple's position as the dominant force in the global true wireless stereo (TWS) earbud market is expected to continue through 2025, according to Counterpoint Research.

The forecast outlines a 3% year-over-year increase in global TWS unit shipments for 2025, signaling a transition from rapid growth to a more mature phase for the category. While Apple is set to remain the leading brand by...

iOS 26 and iPadOS 26 add a smaller yet useful Wi-Fi feature to iPhones and iPads.

As spotted by Creative Strategies analyst Max Weinbach, sign-in details for captive Wi-Fi networks are now synced across iPhones and iPads running iOS 26 and iPadOS 26. For example, while Weinbach was staying at a Hilton hotel, his iPhone prompted him to fill in Wi-Fi details from his iPad that was already...

Apple today seeded the second betas of upcoming iOS 18.6 and iPadOS 18.6 updates to public beta testers, with the betas coming just a day after Apple provided the betas to developers. Apple has also released a second beta of macOS Sequoia 15.6.

Testers who have signed up for beta updates through Apple's beta site can download iOS 18.6 and iPadOS 18.6 from the Settings app on a compatible...