Barclaycard Launches New Apple Rewards Visa Card With 3x Points on Apple Store Purchases

Barclaycard last week announced a revamped version of its credit card partnership with Apple, the Barclaycard Apple Rewards Visa, offering a new Apple rewards program and financing deals (via AppleInsider).

The new reward card offers three points per dollar spent at the Apple Store (iTunes and App Stores do not qualify), two points spent in restaurants, and one point on all other purchases. Once a customer breaks 2,500 points, they receive a $25 Apple Store gift card.

Within the first thirty days of opening an account, users can also finance purchases made through Apple with deferred interest. Purchases under $498 can be financed for six months, $499-$998 for twelve months, and $999 and over for eighteen months.

The last Barclaycard with iTunes Rewards didn't have a triple-points reward tier for customers. It started at paying out two points for every dollar spent at the Apple Store or iTunes Store, and one point for every dollar spent everywhere else. Instead of an Apple Store gift card, the payout at 2,500 points was an iTunes gift card.

The card isn't yet confirmed to work with Apple Pay, but is expected to as both Visa and Barclaycard are participating partners. The new card also supports Chip & Pin security, not Chip & Signature like most other new cards in the United States, with an embedded EMV Chip for security.

The Barclaycard Apple Rewards Visa can be applied for today on Barclaycard's Official Website. Apple is also promoting the new card, touting its reward and financing options, on the company's online store.

Popular Stories

Apple today announced a "special Apple Experience" in New York, London, and Shanghai, taking place on March 4, 2026 at 9:00am ET.

Apple invited select members of the media to the event in three major cities around the world. It is simply described as a "special Apple Experience," and there is no further information about what it may entail. The invitation features a 3D Apple logo design...

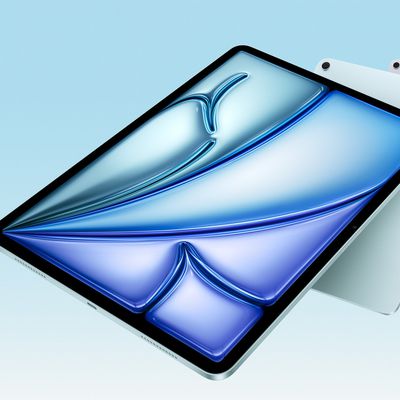

Apple plans to release an iPhone 17e and an iPad Air with an M4 chip "in the coming weeks," according to the latest word from Bloomberg's Mark Gurman.

"Apple retail employees say that inventory of the iPhone 16e has basically dried out and the iPad Air is seeing shortages as well," said Gurman. "I've been expecting new versions of both (iPhone 17e and M4 iPad Air) in the coming weeks."...

Apple on Monday invited selected journalists and content creators to a "special Apple Experience" on Wednesday, March 4 in New York, London, and Shanghai.

At an Apple Experience, attendees are typically given the opportunity to try out Apple's latest hardware or software. Following the launch of Apple Creator Studio last month, for example, some content creators attended an Apple Experience...

Apple's upcoming iPhone 18 Pro and iPhone 18 Pro Max models "won't be a big update," according to Bloomberg's Mark Gurman.

In the latest edition of his "Power On" newsletter, Gurman said that the iPhone 18 Pro models will "represent minor tweaks from last year's iPhone 17 Pro and 17 Pro Max." He compared the upgrade to Apple's past practice of appending the letter "S" to its more minor...

While the iPhone 18 Pro and iPhone 18 Pro Max are still seven months away, an analyst has revealed five new features the devices will allegedly have.

Rumored color options for the iPhone 18 Pro models

In a research note with investment firm GF Securities on Thursday, analyst Jeff Pu outlined the following upgrades for the iPhone 18 Pro models:

Smaller Dynamic Island: It has been rumored...