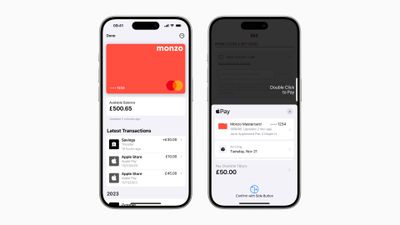

Apple today highlighted the ability in iOS 17.1 for UK users to connect their credit and debit cards in Apple Wallet and easily access information like account balance, spending history, and more.

Users can view their up-to-date bank card balance, payments, deposits, and withdrawals in Wallet and when they're checking out with Apple Pay online or in-apps. Apple says the new feature "empowers users to make more informed purchases, increases their confidence when making a transaction, and allows them to simply view frequent information so that they have more control when it comes to their finances."

From Apple's press release:

"By enabling users to conveniently access their most useful account information within Wallet and at the time of their purchase, they can make informed financial decisions and better understand and manage their spend," said Jennifer Bailey, Apple's vice president of Apple Pay and Apple Wallet. "We look forward to working with U.K. partners under the Open Banking initiative to help users better their financial health, and provide more ways in which banks can deepen their relationships with customers."

Apple added the transaction and card balance functionality to the Wallet app in October's iOS 17.1 update as part of its Connected Cards feature, and several banks have since come on board, including Barclays, Barclaycard, First Direct, Halifax, HSBC, Lloyds, M&S Bank, Monzo Bank, NatWest Bank, and Royal Bank of Scotland.

UK banks support the Open Banking API to integrate with the Wallet app, which has made the feature widely available to UK users, while the Connected Cards rollout in the United States has lagged behind.