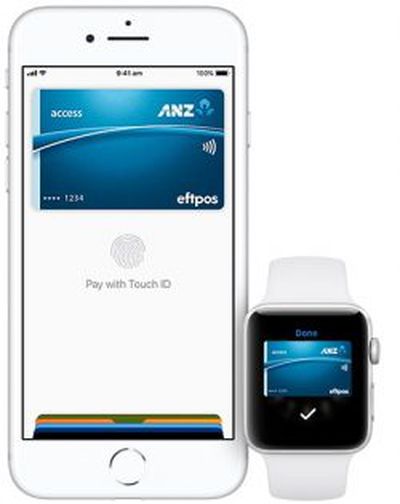

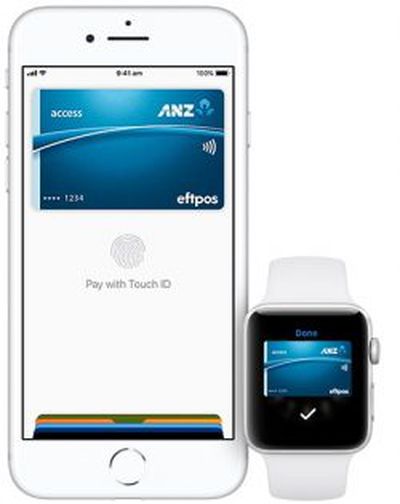

ANZ Eftpos Access Cards Now Support Apple Pay in Australia

Eftpos, a debit payments network in Australia, today announced that ANZ eftpos Access cards now feature support for Apple Pay.

Eftpos, a debit payments network in Australia, today announced that ANZ eftpos Access cards now feature support for Apple Pay.

ANZ is the first bank in Australia to make in-store eftpos mobile payments available to 1.6 million ANZ eftpos Access cardholders through Apple Pay.

Visa, American Express, and MasterCard credit and debit cards issued in Australia by participating banks already supported Apple Pay, but the addition of eftpos is notable as it's widely used in the country.

"Today marks a significant milestone for eftpos as we move from our traditional card based payment method into mobile, enabling consumers with an iPhone or Apple Watch to choose the eftpos account they wish their mobile payment to be made from, being either their eftpos CHQ/SAV account. Customers can set their account preference out of CHQ/SAV and then save themselves entering their account each time they pay. After providing trusted, secure card-based payments for 30 years, eftpos can now also be used to make mobile payments," Mr Jennings said.

"About 1.6 million ANZ eftpos Access cardholders now have the opportunity to make payments on an iPhone or Apple Watch, many of whom may not have had the opportunity to make in store mobile payments before. As Australia's most used debit card network, we are thrilled to be providing ANZ eftpos Access customers with more payment choice, with added benefits of enhanced security and comfort."

As Business Insider points out, support for eftpos reduces fees for both customers and retailers compared to other payment methods.

Support for eftpos is now listed on Apple's Australian Apple Pay website and Apple Pay is available to ANZ Access card customers in Australia immediately.

Popular Stories

Apple's next-generation iPhone 17 Pro and iPhone 17 Pro Max are less than three months away, and there are plenty of rumors about the devices.

Apple is expected to launch the iPhone 17, iPhone 17 Air, iPhone 17 Pro, and iPhone 17 Pro Max in September this year.

Below, we recap key changes rumored for the iPhone 17 Pro models:Aluminum frame: iPhone 17 Pro models are rumored to have an...

The long wait for an Apple Watch Ultra 3 appears to be nearly over, and it is rumored to feature both satellite connectivity and 5G support.

Apple Watch Ultra's existing Night Mode

In his latest Power On newsletter, Bloomberg's Mark Gurman said that the Apple Watch Ultra 3 is on track to launch this year with "significant" new features, including satellite connectivity, which would let you...

The upcoming iPhone 17 Pro and iPhone 17 Pro Max are rumored to have a slightly different MagSafe magnet layout compared to existing iPhone models, and a leaked photo has offered a closer look at the supposed new design.

The leaker Majin Bu today shared a photo of alleged MagSafe magnet arrays for third-party iPhone 17 Pro cases. On existing iPhone models with MagSafe, the magnets form a...

iOS 26 and iPadOS 26 add a smaller yet useful Wi-Fi feature to iPhones and iPads.

As spotted by Creative Strategies analyst Max Weinbach, sign-in details for captive Wi-Fi networks are now synced across iPhones and iPads running iOS 26 and iPadOS 26. For example, while Weinbach was staying at a Hilton hotel, his iPhone prompted him to fill in Wi-Fi details from his iPad that was already...

The iPhone 17 Pro Max will feature the biggest ever battery in an iPhone, according to the Weibo leaker known as "Instant Digital."

In a new post, the leaker listed the battery capacities of the iPhone 11 Pro Max through to the iPhone 16 Pro Max, and added that the iPhone 17 Pro Max will feature a battery capacity of 5,000mAh:

iPhone 11 Pro Max: 3,969mAh

iPhone 12 Pro Max: 3,687mAh...

Apple today seeded the second betas of upcoming iOS 18.6 and iPadOS 18.6 updates to public beta testers, with the betas coming just a day after Apple provided the betas to developers. Apple has also released a second beta of macOS Sequoia 15.6.

Testers who have signed up for beta updates through Apple's beta site can download iOS 18.6 and iPadOS 18.6 from the Settings app on a compatible...

Apple is developing a MacBook with the A18 Pro chip, according to findings in backend code uncovered by MacRumors.

Subscribe to the MacRumors YouTube channel for more videos.

Earlier today, Apple analyst Ming-Chi Kuo reported that Apple is planning to launch a low-cost MacBook powered by an iPhone chip. The machine is expected to feature a 13-inch display, the A18 Pro chip, and color options...

Eftpos, a debit payments network in Australia, today announced that ANZ eftpos Access cards now feature support for Apple Pay.

Eftpos, a debit payments network in Australia, today announced that ANZ eftpos Access cards now feature support for Apple Pay.