Apple Pay Now Supports HSBC and First Direct in the UK

Apple Pay today expanded its participating issuers list within the United Kingdom, adding support for both HSBC and First Direct customers. Both banks were announced as starting partners for the UK branch of Apple Pay, but were delayed until late July at the last minute.

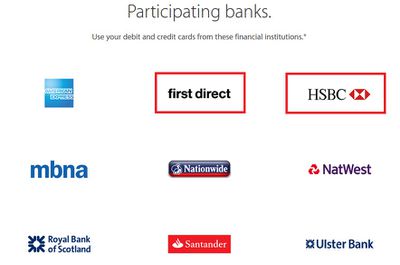

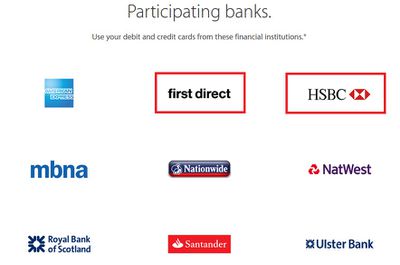

HSBC and First Direct join a list of UK Apple Pay partners that includes: American Express, MBNA, Nationwide, NatWest, Royal Bank of Scotland, Santander and Ulster Bank. Still listed as coming soon are: Bank of Scotland, Lloyds Bank, M&S Bank and TSB. Although Barclays has confirmed "imminent" support for the contactless payment service, the bank has yet to be listed on Apple's Apple Pay UK site.

Along with the announcement of HSBC and First Direct support, customers using Apple Pay in the UK will also be able to start taking advantage of the service at both Five Guys restaurants and Wilko stores across the country. UK support of Apple Pay launched on July 14, and has been steadily expanding its roster of retail partners and financial institutions in the subsequent weeks.

Popular Stories

The long wait for an Apple Watch Ultra 3 appears to be nearly over, and it is rumored to feature both satellite connectivity and 5G support.

Apple Watch Ultra's existing Night Mode

In his latest Power On newsletter, Bloomberg's Mark Gurman said that the Apple Watch Ultra 3 is on track to launch this year with "significant" new features, including satellite connectivity, which would let you...

Apple's next-generation iPhone 17 Pro and iPhone 17 Pro Max are just over two months away, and there are plenty of rumors about the devices.

Below, we recap key changes rumored for the iPhone 17 Pro models.

Latest Rumors

These rumors surfaced in June and July:Apple logo repositioned: Apple's logo may have a lower position on the back of the iPhone 17 Pro models, compared to previous...

The iPhone 17 Pro Max will feature the biggest ever battery in an iPhone, according to the Weibo leaker known as "Instant Digital."

In a new post, the leaker listed the battery capacities of the iPhone 11 Pro Max through to the iPhone 16 Pro Max, and added that the iPhone 17 Pro Max will feature a battery capacity of 5,000mAh:

iPhone 11 Pro Max: 3,969mAh

iPhone 12 Pro Max: 3,687mAh...

Apple's position as the dominant force in the global true wireless stereo (TWS) earbud market is expected to continue through 2025, according to Counterpoint Research.

The forecast outlines a 3% year-over-year increase in global TWS unit shipments for 2025, signaling a transition from rapid growth to a more mature phase for the category. While Apple is set to remain the leading brand by...

AppleInsider's Marko Zivkovic today shared a list of alleged identifiers for future Mac models, which should roll out over the next year or so.

The report does not reveal anything too surprising, but it does serve as further evidence that Apple is seemingly working on new models of every Mac, including the MacBook Air, MacBook Pro, iMac, Mac mini, Mac Studio, and Mac Pro.

Apple is...

The upcoming iPhone 17 Pro and iPhone 17 Pro Max are rumored to have a slightly different MagSafe magnet layout compared to existing iPhone models, and a leaked photo has offered a closer look at the supposed new design.

The leaker Majin Bu today shared a photo of alleged MagSafe magnet arrays for third-party iPhone 17 Pro cases. On existing iPhone models with MagSafe, the magnets form a...