Apple Ranked as World's Top Semiconductor Customer in 2011

Back in June of last year, IHS iSuppli reported that Apple had become the world's largest buyer of semiconductors in 2010, jumping past HP and Samsung to top the list with $17.5 billion in spending. Apple's lead was expected to grow in 2011 on continued strength of the iPhone, iPad, and MacBook Air, all of which contain substantial NAND flash memory, which has become a primary driver of semiconductor markets due to the booming mobile device landscape.

Research firm Gartner is out today with a new report that appears to utilize a somewhat different methodology in calculating semiconductor expenditures but which now comes to the same conclusion as IHS Suppli's earlier report. According to Gartner, Apple became the world's largest semiconductor customer in 2011 as measured by total silicon content in all products designed by Apple and its competitors, known as Design TAM.

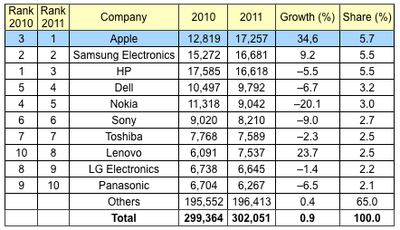

Gartner pegs Apple's year-over-year growth for 2011 at 34.6%, easily topping the growth of other top semiconductor customers and allowing it to leapfrog Samsung and a sliding HP for the top spot in the rankings. According to the report, semiconductor purchases for Apple's products came in at $17.3 billion in 2011, ahead of Samsung's $16.7 billion and HP's $16.6 billion purchases.

iSuppli's report from last year highlighted the vast differences in Apple's and HP's markets, with Apple's semiconductor usage being driven by mobile devices and HP's by traditional computer products. Gartner notes that mobile devices and solid-state drives are indeed now the major drivers of semiconductor usage.

"The major growth drivers in 2011 were smartphones, media tablets and solid-state drives (SSDs)," said Masatsune Yamaji, principal research analyst at Gartner. "Those companies that gained share in the smartphone market, such as Apple, Samsung Electronics and HTC, increased their semiconductor demand, while those who lost market share in this segment, such as Nokia and LG Electronics, decreased their semiconductor demand.

Gartner distinguishes Design TAM from Purchasing TAM, which would attribute to a given company only the amount actually purchased by the company. As an example of the difference between the two metrics, semiconductors purchased by a third-party manufacturing partner would generally count toward the primary company's Design TAM but not its Purchasing TAM.

Popular Stories

A new Apple TV is expected to be released later this year, and a handful of new features and changes have been rumored for the device.

Below, we recap what to expect from the next Apple TV, according to rumors.

Rumors

Faster Wi-Fi Support

The next Apple TV will be equipped with Apple's own combined Wi-Fi and Bluetooth chip, according to Bloomberg's Mark Gurman. He said the chip supports ...

The long wait for an Apple Watch Ultra 3 is nearly over, and a handful of new features and changes have been rumored for the device.

Below, we recap what to expect from the Apple Watch Ultra 3:Satellite connectivity for sending and receiving text messages when Wi-Fi and cellular coverage is unavailable

5G support, up from LTE on the Apple Watch Ultra 2

Likely a wide-angle OLED display that ...

Apple's next-generation iPhone 17 Pro and iPhone 17 Pro Max are only two months away, and there are plenty of rumors about the devices.

Below, we recap key changes rumored for the iPhone 17 Pro models.

Latest Rumors

These rumors surfaced in June and July:A redesigned Dynamic Island: It has been rumored that all iPhone 17 models will have a redesigned Dynamic Island interface — it might ...

Apple will launch its new iPhone 17 series in two months, and the iPhone 17 Pro models are expected to get a new design for the rear casing and the camera area. But more significant changes to the lineup are not expected until next year, when the iPhone 18 models arrive.

If you're thinking of trading in your iPhone for this year's latest, consider the following features rumored to be coming...

The iOS 26 public beta release is quickly approaching, while developers have recently gotten their hands on a third round of betas that has seen Apple continue to tweak features, design, and functionality.

We're also continuing to hear rumors about the iPhone 17 lineup that is now just about right around the corner, while Apple's latest big-budget film appears to be taking off, so read on...

The iPhone's Dynamic Island experience is set to undergo "significant evolution" over the next few years, according to a new rumor.

Earlier this month, a report suggested that the iPhone 17 lineup will feature a redesigned Dynamic Island user interface, but little else was explained about the software changes. Now, the leaker known as "Majin Bu" appears to have corroborated this, commenting ...

![]()