Apple Pay Gains Support for Citi Monthly Payment Plans

Apple Pay now supports Citi Flex Pay, allowing U.S. Citi credit card holders to pay for Apple Pay purchases over time with the Flex Pay option.

Citi Flex Pay is available for Apple Pay purchases over $75. The default payback period is three months, but there are longer payback durations available with a monthly fee. Flex Pay can be used when making purchases on websites or in apps.

To use Citi Flex Pay, an eligible Citi credit card needs to be added to Apple Pay. When making a purchase, select the Citi credit card and then tap on "Pay Later." From there, select a Citi Flex Pay option.

Apple previously had its own buy now, pay later service called Apple Pay Later, but it was discontinued last year. Apple now partners with third-party providers for pay over time options. Apple's other U.S. partners include Affirm, Klarna, and Synchrony.

Popular Stories

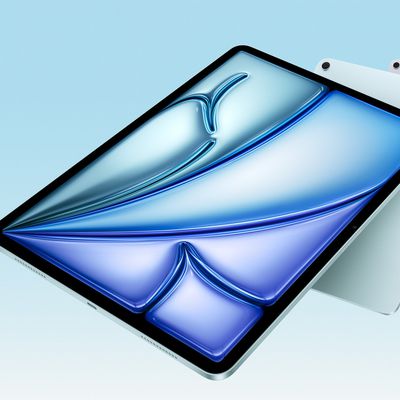

Apple plans to release an iPhone 17e and an iPad Air with an M4 chip "in the coming weeks," according to the latest word from Bloomberg's Mark Gurman.

"Apple retail employees say that inventory of the iPhone 16e has basically dried out and the iPad Air is seeing shortages as well," said Gurman. "I've been expecting new versions of both (iPhone 17e and M4 iPad Air) in the coming weeks."...

Apple plans to launch a rebranded "Sales Coach" app on the iPhone and iPad later this month, according to a source familiar with the matter.

"Sales Coach" will arrive as an update to Apple's existing "SEED" app, and it will continue to provide sales tips and training resources to Apple Store and Apple Authorized Reseller employees around the world. For example, there are articles and videos...

While the iPhone 18 Pro and iPhone 18 Pro Max are still seven months away, an analyst has revealed five new features the devices will allegedly have.

Rumored color options for the iPhone 18 Pro models

In a research note with investment firm GF Securities on Thursday, analyst Jeff Pu outlined the following upgrades for the iPhone 18 Pro models:

Smaller Dynamic Island: It has been rumored...

Apple has a long list of new products rumored for 2026, including a series of home products that will see the company establishing more of a presence in the smart home space. Robots are on the horizon for 2027, but the 2026 releases will be a little tamer.

HomePod mini

We're expecting a new HomePod mini 2 to launch at any time. Apple isn't going to update the device's design, but we could...

Apple is planning to launch new MacBook Pro models as soon as early March, but if you can, this is one generation you should skip because there's something much better in the works.

We're waiting on 14-inch and 16-inch MacBook Pro models with M5 Pro and M5 Max chips, with few changes other than the processor upgrade. There won't be any tweaks to the design or the display, but later this...