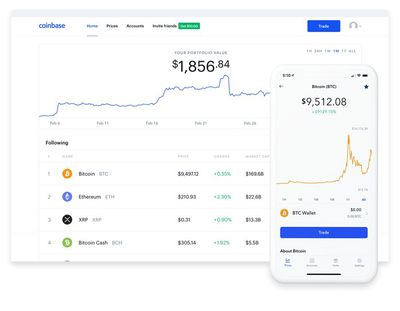

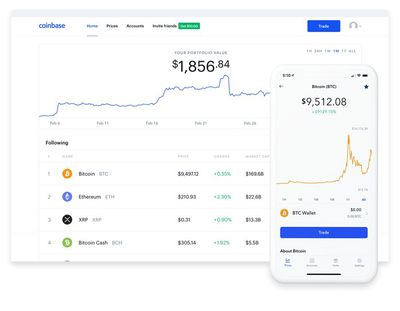

Coinbase Users Can Now Buy Crypto Assets Using Apple Pay

Popular cryptocurrency exchange Coinbase has announced that it is now allowing traders to use bank cards linked to Apple Pay to purchase crypto assets on the platform.

"Today, we're introducing new and seamless ways to enable crypto buys with linked debit cards to Apple Pay and Google Pay, and instant cashouts up to $100,000 per transaction available 24/7," said a Coinbase blog post on Thursday.

"If you already have a Visa or Mastercard debit card linked in your Apple Wallet, Apple Pay will automatically appear as a payment method when you're buying crypto with Coinbase on an Apple Pay-supported iOS device or Safari web browser."

In addition, Coinbase said it is also making it easier and faster for users to access their money by offering instant washouts via Real Time Payments (RTP), allowing customers in the U.S. with linked bank accounts to instantly and securely cash out up to $100,000 per transaction.

In June, Coinbase debit cards gained Apple Pay support, allowing it to be added to the Wallet app on iPhone. The Coinbase Card automatically converts the cryptocurrency that a user wishes to spend to U.S. dollars, and transfers the funds to their Coinbase Card for Apple Pay purchases and ATM withdrawals.

Popular Stories

Apple is planning to launch new MacBook Pro models as soon as early March, but if you can, this is one generation you should skip because there's something much better in the works.

We're waiting on 14-inch and 16-inch MacBook Pro models with M5 Pro and M5 Max chips, with few changes other than the processor upgrade. There won't be any tweaks to the design or the display, but later this...

Wednesday February 11, 2026 10:07 am PST by

Juli CloverApple today released iOS 26.3 and iPadOS 26.3, the latest updates to the iOS 26 and iPadOS 26 operating systems that came out in September. The new software comes almost two months after Apple released iOS 26.2 and iPadOS 26.2.

The new software can be downloaded on eligible iPhones and iPads over-the-air by going to Settings > General > Software Update.

According to Apple's release notes, ...

Apple plans to release an iPhone 17e and an iPad Air with an M4 chip "in the coming weeks," according to the latest word from Bloomberg's Mark Gurman.

"Apple retail employees say that inventory of the iPhone 16e has basically dried out and the iPad Air is seeing shortages as well," said Gurman. "I've been expecting new versions of both (iPhone 17e and M4 iPad Air) in the coming weeks."...

The MacBook Air is Apple's most popular laptop – a thin, fanless machine that wields quiet power thanks to the efficiency of Apple silicon. While the M4 model isn't exactly old, attention is already turning to its successor.

Apple doesn't telegraph new product launches ahead of time, but we can draw a surprisingly clear picture of what to expect by looking at Apple's silicon roadmap,...

Apple plans to announce the iPhone 17e on Thursday, February 19, according to Macwelt, the German equivalent of Macworld.

The report said the iPhone 17e will be announced in a press release on the Apple Newsroom website, so do not expect an event for this device specifically.

The iPhone 17e will be a spec-bumped successor to the iPhone 16e. Rumors claim the device will have four key...