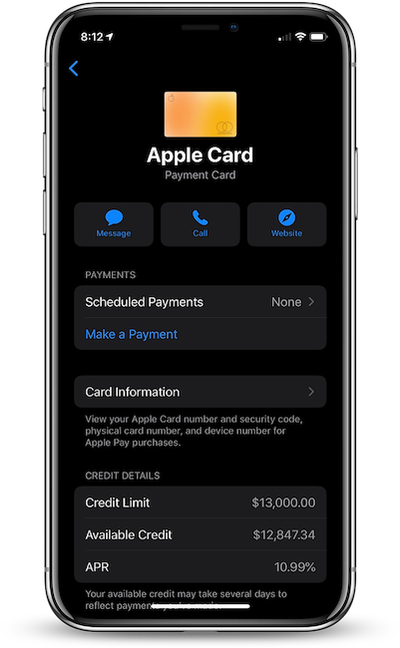

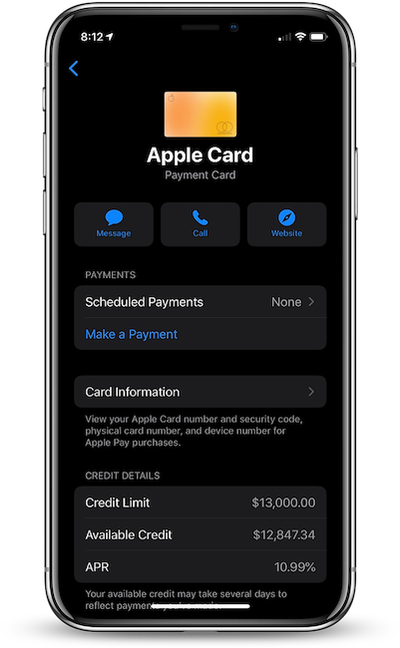

Apple Card's Base APR Lowered to 10.99% for Some Cardholders

Following two interest rate cuts by the U.S. Federal Reserve in March, the Apple Card's base APR has now decreased from 12.49 percent to 10.99 percent for some cardholders, including MacRumors reader Zed and others on Reddit.

This is at least the third time that the Apple Card's APR range has been lowered since the credit card launched in August 2019.

Due to current affairs, Apple recently launched a customer assistance program that allows Apple Card holders to skip their March and April payments without incurring interest charges. To enroll in the program, read Apple's support document.

Key features of the Apple Card include color-coded spending summaries in the Wallet app, no fees beyond any applicable interest, and up to three percent daily cashback.

To apply for an Apple Card, simply open the Wallet app on an iPhone running iOS 12.4 or later, tap the plus button in the top-right corner, and follow the on-screen steps. The process takes just a few minutes, and if approved, your digital Apple Card will be ready for purchases immediately. A physical titanium-based Apple Card is also available for use at retail stores that do not accept contactless payments.

Popular Stories

While the iOS 26.3 Release Candidate is now available ahead of a public release, the first iOS 26.4 beta is likely still at least a week away. Following beta testing, iOS 26.4 will likely be released to the general public in March or April.

Below, we have recapped known or rumored iOS 26.3 and iOS 26.4 features so far.

iOS 26.3

iPhone to Android Transfer Tool

iOS 26.3 makes it easier...

Apple recently acquired Israeli startup Q.ai for close to $2 billion, according to Financial Times sources. That would make this Apple's second-biggest acquisition ever, after it paid $3 billion for the popular headphone maker Beats in 2014.

This is also the largest known Apple acquisition since the company purchased Intel's smartphone modem business and patents for $1 billion in 2019....

In 2022, Apple introduced a new Apple Home architecture that is "more reliable and efficient," and the deadline to upgrade and avoid issues is fast approaching.

In an email this week, Apple gave customers a final reminder to upgrade their Home app by February 10, 2026. Apple says users who do not upgrade may experience issues with accessories and automations, or lose access to their smart...

New M5 Pro and M5 Max MacBook Pro models are slated to launch in the near future, according to information shared with MacRumors by an Apple Premium Reseller.

Subscribe to the MacRumors YouTube channel for more videos.

The third-party Apple retailer said that MacBook Pro stock is very low currently because there is an imminent new product introduction. Apple typically coordinates supply with...

The calendar has turned to February, and a new report indicates that Apple's next product launch is "imminent," in the form of new MacBook Pro models.

"All signs point to an imminent launch of next-generation MacBook Pros that retain the current form factor but deliver faster chips," Bloomberg's Mark Gurman said on Sunday. "I'm told the new models — code-named J714 and J716 — are slated...