Apple Repurchases $14 Billion in Shares in 2 Weeks, Company Open to Large Acquisitions

Apple has repurchased $14 billion of its own stock in the two weeks following its first quarter earnings call on January 27th, according to a report in The Wall Street Journal.

Apple has repurchased $14 billion of its own stock in the two weeks following its first quarter earnings call on January 27th, according to a report in The Wall Street Journal.

The Journal spoke to Apple CEO Tim Cook who said that Apple wanted to be "aggressive" and "opportunistic" with its repurchases after Apple's share price dropped 8 percent the day after the results were reported.

With the latest purchases, Mr. Cook said Apple had bought back more than $40 billion of its shares over the past 12 months, which Mr. Cook said was a record for any company over a similar span.

"It means that we are betting on Apple. It means that we are really confident on what we are doing and what we plan to do," said Mr. Cook, speaking in a conference room at the company's corporate headquarters here. "We're not just saying that. We're showing that with our actions."

He went on to say that the company would share "updates" to its buyback program in March or April, roughly a year after it more than doubled its capital return program to $100 billion. Apple has bought back $40 billion in shares over the past 12 months.

Cook said that though Apple has not made any large acquisitions, it is open to making a big purchase if it made financial sense: "We have no problem spending ten figures for the right company, for the right fit that's in the best interest of Apple in the long-term. None. Zero."

As of its earnings call last month, Apple had $158.8 billion in cash, with $34.4 billion located in the United States. It's likely that the repurchase was done entirely with Apple's domestic cash.

Popular Stories

Apple today confirmed to Reuters that it has acquired Q.ai, an Israeli startup that is working on artificial intelligence technology for audio.

Apple paid close to $2 billion for Q.ai, according to sources cited by the Financial Times. That would make this Apple's second-biggest acquisition ever, after it paid $3 billion for the popular headphone and audio brand Beats in 2014.

Q.ai has...

Apple recently updated its online store with a new ordering process for Macs, including the MacBook Air, MacBook Pro, iMac, Mac mini, Mac Studio, and Mac Pro.

There used to be a handful of standard configurations available for each Mac, but now you must configure a Mac entirely from scratch on a feature-by-feature basis. In other words, ordering a new Mac now works much like ordering an...

Last year, Apple launched CarPlay Ultra, the long-awaited next-generation version of its CarPlay software system for vehicles. Nearly nine months later, CarPlay Ultra is still limited to Aston Martin's latest luxury vehicles, but that should change fairly soon.

In May 2025, Apple said many other vehicle brands planned to offer CarPlay Ultra, including Hyundai, Kia, and Genesis. At the time,...

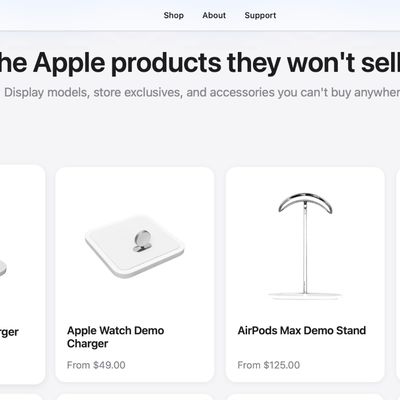

A newly surfaced resale operation is seemingly offering Apple Store–exclusive display accessories to the public for the first time, potentially giving consumers access to Apple-designed hardware that the company has historically kept confined to its retail environments.

Apple designs a range of premium MagSafe charging stands, display trays, and hardware systems exclusively for displays in ...

Apple today introduced its first two physical products of 2026: a second-generation AirTag and the Black Unity Connection Braided Solo Loop for the Apple Watch.

Read our coverage of each announcement to learn more:Apple Unveils New AirTag With Longer Range, Louder Speaker, and More

Apple Introduces New Black Unity Apple Watch BandBoth the new AirTag and the Black Unity Connection Braided...

Apple has repurchased $14 billion of its own stock in the two weeks following its first quarter earnings call on January 27th, according to a report in The Wall Street Journal.

Apple has repurchased $14 billion of its own stock in the two weeks following its first quarter earnings call on January 27th, according to a report in The Wall Street Journal.