Apple's Weighting in Nasdaq-100 Cut

Apple's weighting in the Nasdaq-100 Index

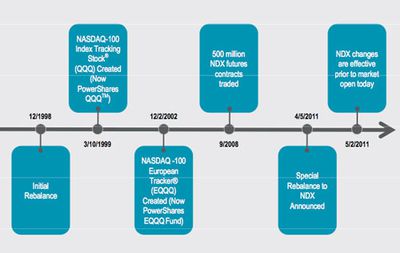

will be cut on May 2nd to reduce Apple's influence on the stock index.

Apples representation will be reduced to 12.33 percent of the index on May 2, from 20.49 percent, Nasdaq OMX Group Inc. said in a slide show on its website today, after previous rules caused its proportion in the gauge to grow disproportionately. The weightings of Microsoft Corp. and Cisco Systems Inc. will more than double.

Apple's weighting in the stock index is said to be overrepresented at 6x the value of the second largest stock (Microsoft) despite only having a 46 percent larger market value.

The Nasdaq-100 consists of the 100 largest nonfinancial stocks that trade on the Nasdaq. According to Wall Street Journal, over $330 billion worth of assets track the index via exchange-traded funds, mutual funds, options and futures. The move could hurt Apple's stock price due to significant selling pressure as indexes adjust to the new weightings:

The rebalancing is likely to kick off waves of trading in the stock market as money managers scramble to adjust holdings to reflect the new composition of the index. There are more than 2,900 financial products tracking the Nasdaq-100 in 27 countries, Nasdaq says. That includes the $24.4 billion PowerShares QQQ exchange-traded fund, which over the past year has been the sixth most actively traded stock on U.S. exchanges.

The changes go into effect on May 2nd.

Popular Stories

The long wait for an Apple Watch Ultra 3 appears to be nearly over, and it is rumored to feature both satellite connectivity and 5G support.

Apple Watch Ultra's existing Night Mode

In his latest Power On newsletter, Bloomberg's Mark Gurman said that the Apple Watch Ultra 3 is on track to launch this year with "significant" new features, including satellite connectivity, which would let you...

Apple's next-generation iPhone 17 Pro and iPhone 17 Pro Max are just over two months away, and there are plenty of rumors about the devices.

Below, we recap key changes rumored for the iPhone 17 Pro models.

Latest Rumors

These rumors surfaced in June and July:Apple logo repositioned: Apple's logo may have a lower position on the back of the iPhone 17 Pro models, compared to previous...

The iPhone 17 Pro Max will feature the biggest ever battery in an iPhone, according to the Weibo leaker known as "Instant Digital."

In a new post, the leaker listed the battery capacities of the iPhone 11 Pro Max through to the iPhone 16 Pro Max, and added that the iPhone 17 Pro Max will feature a battery capacity of 5,000mAh:

iPhone 11 Pro Max: 3,969mAh

iPhone 12 Pro Max: 3,687mAh...

Apple's position as the dominant force in the global true wireless stereo (TWS) earbud market is expected to continue through 2025, according to Counterpoint Research.

The forecast outlines a 3% year-over-year increase in global TWS unit shipments for 2025, signaling a transition from rapid growth to a more mature phase for the category. While Apple is set to remain the leading brand by...

AppleInsider's Marko Zivkovic today shared a list of alleged identifiers for future Mac models, which should roll out over the next year or so.

The report does not reveal anything too surprising, but it does serve as further evidence that Apple is seemingly working on new models of every Mac, including the MacBook Air, MacBook Pro, iMac, Mac mini, Mac Studio, and Mac Pro.

Apple is...

The upcoming iPhone 17 Pro and iPhone 17 Pro Max are rumored to have a slightly different MagSafe magnet layout compared to existing iPhone models, and a leaked photo has offered a closer look at the supposed new design.

The leaker Majin Bu today shared a photo of alleged MagSafe magnet arrays for third-party iPhone 17 Pro cases. On existing iPhone models with MagSafe, the magnets form a...