Analysts Predict Apple Will Report Single-Digit Earnings Growth in 1Q 2014

Analysts predict Apple will return to growth when the company announces its quarterly earnings later today, reports Philip Elmer-Dewitt of Fortune. Growth will be in the single digits and will be an improvement over the negative earnings growth the company reported for the previous three quarters. Apple is not, however, expected to return to the 50% growth it achieved between 2010 and 2012.

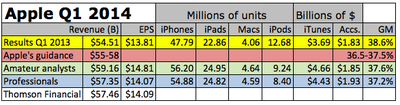

The consensus estimates among the 47 Apple analysts we've heard from so far -- 29 Wall Street professionals and 18 Internet amateurs -- are for earnings of $14.36 per share on sales of $58.1 billion. That represents year-over-year growth of 4.0% for earnings and 6.6% for revenue.

Eighty percent of Fortune's surveyed analysts estimate Apple's revenue will fall within the company's guidance of $55 to $58 billion. Six analysts predict Apple will beat the street with revenue that tops $58 billion. Consensus estimates also predict Apple will sell a record 55 million iPhones and 25 million iPads in 1Q 2014.

Apple will report its quarterly earnings today after the close of trading, at approximately 4:30 PM Eastern / 1:30 PM Pacific. MacRumors will have full coverage of Apple's earnings release and the conference call taking place at 5:00 PM Eastern / 2:00 PM Pacific.

Popular Stories

iOS 18 is expected to be the "biggest" update in the iPhone's history. Below, we recap rumored features and changes for the iPhone. iOS 18 is rumored to include new generative AI features for Siri and many apps, and Apple plans to add RCS support to the Messages app for an improved texting experience between iPhones and Android devices. The update is also expected to introduce a more...

A week after Apple updated its App Review Guidelines to permit retro game console emulators, a Game Boy emulator for the iPhone called iGBA has appeared in the App Store worldwide. The emulator is already one of the top free apps on the App Store charts. It was not entirely clear if Apple would allow emulators to work with all and any games, but iGBA is able to load any Game Boy ROMs that...

Apple today said it removed Game Boy emulator iGBA from the App Store for violating the company's App Review Guidelines related to spam (section 4.3) and copyright (section 5.2), but it did not provide any specific details. iGBA was a copycat version of developer Riley Testut's open-source GBA4iOS app. The emulator rose to the top of the App Store charts following its release this weekend,...

Apple's first set of new AI features planned for iOS 18 will not rely on cloud servers at all, according to Bloomberg's Mark Gurman. "As the world awaits Apple's big AI unveiling on June 10, it looks like the initial wave of features will work entirely on device," said Gurman, in the Q&A section of his Power On newsletter today. "That means there's no cloud processing component to the...

Best Buy this weekend has a big sale on Apple MacBooks and iPads, including new all-time low prices on the M3 MacBook Air, alongside the best prices we've ever seen on MacBook Pro, iPad, and more. Some of these deals require a My Best Buy Plus or My Best Buy Total membership, which start at $49.99/year. In addition to exclusive access to select discounts, you'll get free 2-day shipping, an...

Bloomberg's Mark Gurman recently reported that the first Macs with M4 series chips will be released later this year, with more models to follow next year. In his Power On newsletter today, Gurman shared a more specific roadmap for these Macs. Here is the order in which Gurman expects the Macs to launch:1. A low-end 14-inch MacBook Pro with the M4, coming around the end of 2024. 2. A 24-inch ...

Apple's hardware roadmap was in the news this week, with things hopefully firming up for a launch of updated iPad Pro and iPad Air models next month while we look ahead to the other iPad models and a full lineup of M4-based Macs arriving starting later this year. We also heard some fresh rumors about iOS 18, due to be unveiled at WWDC in a couple of months, while we took a look at how things ...

Over the weekend, a Game Boy emulator named iGBA appeared in the iPhone's App Store, but Apple quickly removed the app due to violations of the company's App Review Guidelines related to spam and copyright. Apple has since shared additional details about why it removed iGBA from the App Store, and it also clarified its guidelines for emulators. iGBA was a copycat version of developer Riley...

Top Rated Comments

I hope they can keep Icahn and his bandwagon buddies out of their business.

Unless the subject is Amazon, then it seems to be just fine that they've never made money...