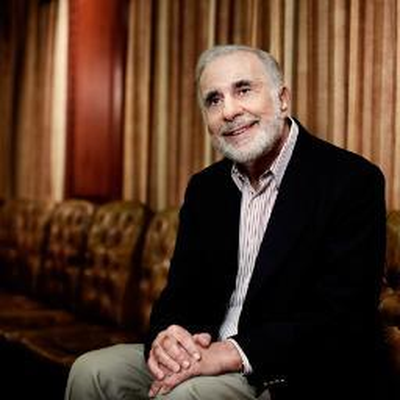

Carl Icahn Discloses 'Large Position' in Apple, Believes Company is 'Extremely Undervalued'

Legendary investor Carl Icahn disclosed on Twitter today that his holding company has taken a 'large position' in Apple, believing that the company is 'extremely undervalued' and should increase its share buyback program.

Legendary investor Carl Icahn disclosed on Twitter today that his holding company has taken a 'large position' in Apple, believing that the company is 'extremely undervalued' and should increase its share buyback program.

This is similar to the advice that Warren Buffett gave earlier this year, though Buffett did not take a position in Apple.

Icahn disclosed his position on Twitter after yesterday warning investors that he may disclose material information on that account in accordance with new SEC guidelines on social media use.

We currently have a large position in APPLE. We believe the company to be extremely undervalued. Spoke to Tim Cook today. More to come. - 12:21 PM - 13 Aug 13

Had a nice conversation with Tim Cook today. Discussed my opinion that a larger buyback should be done now. We plan to speak again shortly. - 12:25 PM - 13 Aug 13

Icahn, who has an estimated net worth of $20 billion, has recently been extensively involved in efforts to keep Dell from going private and he also holds a 16% stake in Nuance, the speech recognition company that Apple uses for Siri.

Update: According to Bloomberg, Icahn has taken a position of at least $1 billion in Apple and is projecting the stock price to rise to over $600.

Update 2: Apple issued this statement regarding Icahn's investment:

We appreciate the interest and investment of all our shareholders. Tim had a very positive conversation with Mr. Icahn today.

Update 3: The Wall Street Journal has more from an interview with Mr. Icahn.

"This is a no brainer to go buy stock in a company that can go borrow" at a low rate, Mr. Icahn said. "Buy the company here and even without earnings growth, we think it ought to be worth $625."

Mr. Icahn's thesis rests on Apple borrowing at about a 3% interest rate and buying back shares right now, likely at around $525 a piece. That would send shares to $625, Mr. Icahn says, without taking into account any earnings growth.

Popular Stories

Game emulator apps have come and gone since Apple announced App Store support for them on April 5, but now popular game emulator Delta from developer Riley Testut is available for download. Testut is known as the developer behind GBA4iOS, an open-source emulator that was available for a brief time more than a decade ago. GBA4iOS led to Delta, an emulator that has been available outside of...

The first approved Nintendo Entertainment System (NES) emulator for the iPhone and iPad was made available on the App Store today following Apple's rule change. The emulator is called Bimmy, and it was developed by Tom Salvo. On the App Store, Bimmy is described as a tool for testing and playing public domain/"homebrew" games created for the NES, but the app allows you to load ROMs for any...

Last September, Apple's iPhone 15 Pro models debuted with a new customizable Action button, offering faster access to a handful of functions, as well as the ability to assign Shortcuts. Apple is poised to include the feature on all upcoming iPhone 16 models, so we asked iPhone 15 Pro users what their experience has been with the additional button so far. The Action button replaces the switch ...

A decade ago, developer Riley Testut released the GBA4iOS emulator for iOS, and since it was against the rules at the time, Apple put a stop to downloads. Emulators have been a violation of the App Store rules for years, but that changed on April 5 when Apple suddenly reversed course and said that it was allowing retro game emulators on the App Store. Subscribe to the MacRumors YouTube channel ...

iOS 18 is expected to be the "biggest" update in the iPhone's history. Below, we recap rumored features and changes for the iPhone. iOS 18 is rumored to include new generative AI features for Siri and many apps, and Apple plans to add RCS support to the Messages app for an improved texting experience between iPhones and Android devices. The update is also expected to introduce a more...

Legendary investor Carl Icahn disclosed on Twitter today that his holding company has taken a 'large position' in Apple, believing that the company is 'extremely undervalued' and should increase its share buyback program.

Legendary investor Carl Icahn disclosed on Twitter today that his holding company has taken a 'large position' in Apple, believing that the company is 'extremely undervalued' and should increase its share buyback program.

Top Rated Comments

And with that, Icahn just made everything that Ellison said yesterday a crock.

BL.

You need to go outside and seek help immediately. I'm being serious, your post is pretty indicative of someone who needs help working through some larger issue.

I'm smelling that to. Goes along with the quote, "The best way to predict the future is to make it."