Apple Rises to #5 in This Year's Fortune 500 Rankings

Fortune has just released its annual "Fortune 500" list, which is a high-profile ranking of the largest companies in the United States ranked by revenue. This year, Apple has taken the #5 spot, up from #6 in last year's rankings and from #17 in 2012.

Apple’s net sales keep climbing, as the tech giant continues to sell more iPhones and digital content. But the company faces pressure in the smartphone business, as Android phones grow increasingly dominant. Meanwhile, Apple reported an annual drop in net income in fiscal year 2013, a first in more than a decade. Activist investor Carl Icahn last year disclosed a stake in Apple and subsequently pushed for the company to spend billions on share buybacks. In April, the company increased the amount of shares it is authorized to repurchase and raised its quarterly dividend by 8%, and in late May it announced it was acquiring Beats Music and Beats Electronics for $3 billion.

Wal-Mart once again beat out ExxonMobil for this year's #1 ranking, with Chevron and Berkshire Hathaway ranking ahead of Apple's $170.9 billion in revenue. Apple's profit of $37 billion dollars also ranked first among Fortune 500 companies despite falling 11.3% from last year.

Apple announced last week that it would be buying Beats Electronics and the Beats Music streaming service for a total of $3 billion, making it the largest acquisition in company history. Apple is also expected to launch a number of new products this year, including a larger iPhone, new Macs, new versions of OS X and iOS, and an "iWatch" smartwatch.

Popular Stories

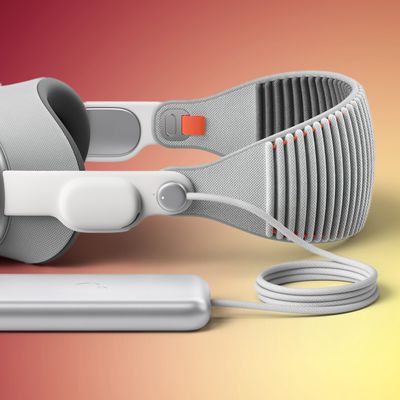

Apple has stopped production of FineWoven accessories, according to the Apple leaker and prototype collector known as "Kosutami." In a post on X (formerly Twitter), Kosutami explained that Apple has stopped production of FineWoven accessories due to its poor durability. The company may move to another non-leather material for its premium accessories in the future. Kosutami has revealed...

The lead developer of the multi-emulator app Provenance has told iMore that his team is working towards releasing the app on the App Store, but he did not provide a timeframe. Provenance is a frontend for many existing emulators, and it would allow iPhone and Apple TV users to emulate games released for a wide variety of classic game consoles, including the original PlayStation, GameCube, Wii,...

The upcoming iOS 17.5 update for the iPhone includes only a few new user-facing features, but hidden code changes reveal some additional possibilities. Below, we have recapped everything new in the iOS 17.5 and iPadOS 17.5 beta so far. Web Distribution Starting with the second beta of iOS 17.5, eligible developers are able to distribute their iOS apps to iPhone users located in the EU...

Apple Vision Pro, Apple's $3,500 spatial computing device, appears to be following a pattern familiar to the AR/VR headset industry – initial enthusiasm giving way to a significant dip in sustained interest and usage. Since its debut in the U.S. in February 2024, excitement for the Apple Vision Pro has noticeably cooled, according to Bloomberg's Mark Gurman. Writing in his latest Power On...

It was a big week for retro gaming fans, as iPhone users are starting to reap the rewards of Apple's recent change to allow retro game emulators on the App Store. This week also saw a new iOS 17.5 beta that will support web-based app distribution in the EU, the debut of the first hotels to allow for direct AirPlay streaming to room TVs, a fresh rumor about the impending iPad Air update, and...

Top Rated Comments

These professional pundits always seem to think that the most important metric is revenue or market share or anything else but profit. As I understand, any company in business is only interested in working hard and well enough to MAKE A PROFIT. Apple is doing the best possible job of making a profit while also making great products and services. People love them like no other company on earth and still that isn't good enough for these pundits. Anything to bring down greatness.

Plus the NFL is a not for profit group - if you can somehow wrap your head around that :rolleyes:

That's what you are able to do if you produce amazing products.