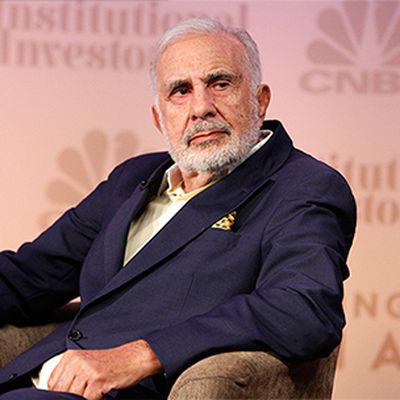

Carl Icahn

By MacRumors Staff

Carl Icahn Articles

Investor Carl Icahn Dumps Apple Shares Over China Concerns

Billionaire Carl Icahn, who has been buying large amounts of Apple stock over the past three years, today told CBNC that he sold his stake in the company."We no longer have a position in Apple," Icahn told CNBC's "Power Lunch" on Thursday, noting Apple is a "great company" and CEO Tim Cook is "doing a great job."Icahn, who sold his shares earlier this year, said that he did so based on worries...

Read Full Article 419 comments

Carl Icahn Still Believes in Apple HDTV as AAPL's Market Cap Surpasses $750 Billion

Activist investor and billionaire Carl Icahn, during an interview with CNBC today, expressed confusion over The Wall Street Journal's recent report claiming that Apple scrapped its plans for a full television set more than a year ago. Icahn and his investment firm Icahn Enterprises remain confident that Apple will enter the television and automotive spaces, even as analyst Gene Munster admits he...